Outlook for the Middle East out to 2015

2014 has not been without its challenges, and 2015 will

also be another difficult year. However, on average MBR

believes that rebar prices on average will only be 3-5%

lower compared to 2014 on a GCC cif basis. Despite

these challenges to steelmaker margins in the Middle

East, our outlook remains bright for the region. We

present our arguments to validate this view below.

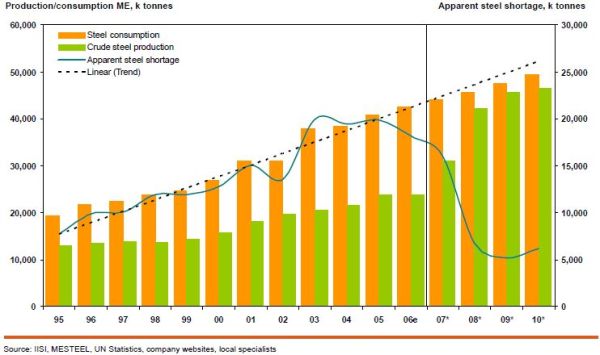

The region in 2014 remained one of the fastestgrowing

in terms of steel production and

consumption, second only to Asia. GCC finished

steel consumption rose by 6.0% in 2014 and is

forecast to further grow by 6.1% in 2015.

Government federal budgets are largely set now.

Although based on nominal oil prices, it is our

view that the vast majority of the governments in

the region are still committed to large long-term

infrastructure and social investment – in part for

political reasons to avoid another Arab Spring.

Many of the Gulf economies have recorded large

budget surpluses for the past three years. They

would be willing therefore to run short-term

deficits in order to continue these investments.

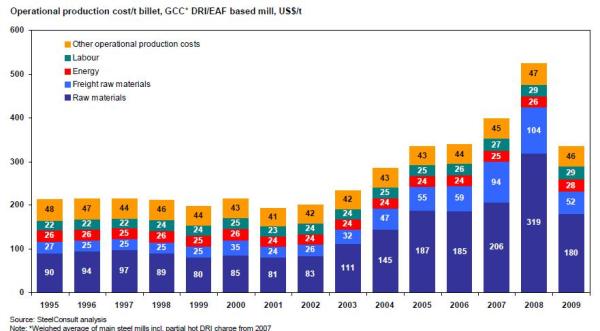

Regional DRI-EAF producers are still extremely lowcost

thanks to low-priced natural gas, which is priced

well below international levels. Moreover, these are

often fixed under long-term contracts providing

substantial advantages over the longer-term. Other

subsidies include long-term power contracts or

discounted power access or access to state-backed

financing. There are also buy-local schemes in GCC

markets such as Kuwait that provide financing based

on buying locally-sourced steel.

The recent complaints about China may fade

in 2015 as less Chinese material arrives into

the Middle East. There are two parts to this

hypothesis:

First we factor in that China has amended its

export tax rebate in January 2015. The removal

of the VAT rebate on alloy long product exports

will add around $40/tonne or so to Chinese

export costs.

Secondly, in our opinion, it has been relative

cost advantages that have fuelled a large part

of Chinese export volumes we have seen in

2014. We expect this dynamic to change from

2015.

This view is more convincing and powerful if we

take the running assumption that the Chinese

government will act to further stimulate steel

demand growth next year. There are three key

reasons why:

i) Falling oil prices and metals prices in China will

naturally give a positive boost to manufacturing

and stimulate internal-led GDP growth.

ii) Rising deflation makes borrowing more

expensive and for those Chinese firms who are

indebted makes it harder for them to service

their debts

iii) Rising deflation presents new room for the

Chinese government to go beyond the recent

surprise changes to interest rates and provide

further growth monetary stimulus to the

economy.

Given that China is therefore moving into a deflationary

period this means that to regain credibility and policy

effectiveness the Chinese government will need to ease

monetary policy much more, probably in the form of

lowering the reserve requirement ratios among China’s

banks at least throughout the first half of 2015. This

would be a positive move to mitigate Chinese steel

exports to global markets for 2015.

In conclusion and in our opinion, 2015 will mark the

low-point for global steel products for several years,

however, steel prices are not expected to dramatically

fall for the reasons outlined above. Fundamentally,

there will be a recovery through 2016 – albeit with

continued cyclicality and with Chinese mills capping

any major price increase with rising exports.

Why steelmaker attempts at further trade

protectionism in 2015 will utimately fail

Steelmakers in the Middle East are clamouring to seek

out legal advice as to how they can copy Egypt (in the

case of Turkish rebars) and others and look to protect

their markets from imports beyond the current 5%

import duty.

Irrespective, in many circumstances, we do not

believe that governments will provide additional

protection steelmakers may look to seek. There will

be little rest bite among regional steelmaker margins

in 2015. We list some key reasons below:

In many countries, it is the state that drives

much of the infrastructure expenditure

on which steel consumption is based.

Cheap housing for a growing young Arab

population is a key priority for many

governments. By protecting the domestic

steel industry, it would therefore ensure

that it pays a higher price for its capital

investment.

It also passes the cost down to further steel

processing or manufacturing industries.

These then pay a higher price and are then

even less able to be competitive with imports.

With many regional governments seeking

to diversify their economies and encourage

manufacturing, we find it hard to believe that

they will act to widely damage manufacturing

industry by protecting the steel industry.

According to a recent report, the Arab world

needs as many as 17m new jobs by 2020

based on demographic calculations.

Finally, many countries either do not have

the right legal infrastructure/frameworks

to best deal with such complicated trade

issues, or the decision-makers at the

very top would have their own business

interests affected by higher steel costs. So

regional steelmakers can prepare all the

documentation and reports they want to try

and prove a convincing case for hiking up

import tariffs, but this will continue to find a

lack of support or drive at many of the key

levels of government.