In 1927, plans were drawn up to establish smelting works in the north of the country to produce rail tracks domestically. This action was in connection with the go-ahead given by the parliament (Majles) to start the construction of a railway between Kòor Musa@ and Moháammara. Out of the railway budget, 4.5 million toma@ns were earmarked for this purpose, and a German expert was engaged to make a feasibility study. Suitable iron had been found near Semna@n, but no coal. The works would be dependent on the ˆemæak coalmine, which was about 100 miles away, so a special railway would have to be built between the mine and the works; moreover, it was feared that the ore deposits at Semna@n would be exhausted in fifteen years if the works were to operate at full capacity. As a result, the project fell through at the end of 1928. In early 1928 bids had actually been invited, despite the fact that the feasibility study had estimated the costs to be twice the amount which the Majles had allotted, while the German Krupp corporation, one of the world’s principal steelmakers and arms manufacturers until the end of World War II, even estimated the costs to be much higher.

Although the government shelved the project for the moment, it did not forget about it. In 1938, an agreement was reached, after much study and preparation, between Iran and a German consortium (Demag-Krupp) for the construction of two blast furnaces with a daily production of 150 tons, a steel factory, a rolling mill, a wire-drawing mill, a foundry, a wrought ironworks, a coke crusher, a power plant, and some ancillary industries such as a lime plant, an ammonia and benzol plant, and a tar distillation plant. The works were to be completed in three and a half years time and would employ 1,200 workers when working at full capacity. The original site was planned to be south of Tehran near the cement works, but Karaj was chosen instead, because of its more suitable water supply. A disadvantage, however, was that coal supplies for the power plant and the blast furnaces had to be transported from ˆemæak and Zira@b at about 35 miles distance. In 1939, Rezµa@ Shah laid the first foundation stone, and, although work proceeded as planned, the works were still unfinished in 1941 when the Allies invaded Iran. This event meant, of course, that the whole project was jeopardized, for all relations with Germany (q.v.) were cut, which led to the demise of the project. Part of the machinery was still at sea when World War II broke out and was seized by the Allies, and the rest remained in Germany and rusted away. The partly completed buildings at Karaj became dilapidated (Floor, 1984; Koellner). There were also a small number of traditional iron foundries and blast furnaces in Ma@zandara@n, and the erection of a new plant in that area to smelt 300 tons of iron per day was being considered (Gupta, p. 75; Elwell-Sutton, p. 104).

After World War II, the government wanted to complete the Karaj factory (subject to availability of coal) to manufacture rails, sleepers, iron beams and sheets (Za@hedi, pp. 58-64). However, the Overseas Consultants’ report advised against it (Roberts, p. 234; Overseas Consultants, IV, pp. 184-85). Since then, “more has been said and less done about a steel industry than any other industry in Iran” (Echo of Iran, 1965, p. 277). For the government persisted in its desire to have a steel mill and hired a continuous flow of 25 different groups of consultants, who all came to the same conclusion that the steel mill was not viable. Although the Krupp corporation agreed in 1952 to renew its contract to build the mill, the World Bank (International Bank for Reconstruction and Development, IBRD) refused to finance the project in 1959. In 1961, a proposal prepared by the London-based Kaiser Engineers Corporation for a rolling mill at Karaj, as the first phase of an integrated steel mill, also was unable to obtain IBRD financing. The project then was shelved, although funds had been allocated in the Third Development Plan. A project for a private foundry in Khuzestan to process imported scrap (35,000 tons per year) was approved. The project was only realized in 1963, when an agreement was reached between a private Iranian and a Swedish company to build the scrap metal steel mill. Meanwhile, the army’s munitions factories acquired a five-ton foundry and the Iranian State Railways a 10-ton per day electric arc foundry. Ma@æinsa@zi-ye Ira@n, a private company, built a cast-iron foundry in 1960 at Ahva@z (q.v.) with an annual capacity of 6,000 tons. It produced mainly cast-iron pipes (Echo of Iran, 1963, pp. 277, 297; 1965, p. 239).

The basis for future steel production in Iran was laid by the signing of a contract with the USSR in 1965 to finance and erect a steel plant in Isfahan (National Iranian Steel Company, NISC). Repayment of the loan was done through deliveries of natural gas from Iran to the USSR. The state-owned plant consisted of four production units using blast furnace processing technology with a production capacity of 550,000 tons per year. The Isfahan steel plant (Aryamehr Steel Mill, later called Dòawb-a@han-e Esáfaha@n) was commissioned, and its cast iron department came into operation in 1971. At that time, a contract for the expansion of the Isfahan steel plant to a capacity of 1.9 million tons per year of structural steel was signed with the USSR. Work started in 1973, but due to political and economic upheaval the plant was not completed until 1983. The private-sector Iran National Steel Industries Group (INSIG, Goruh-e Melli-ye S®an¿ati-ye Fula@d-e Ira@n) erected a second 85,000 tons per year rolling mill (ˆa@hin), also at Ahva@z, in 1969, and ordered a third one (ˆahya@r, 120,000 tons per year) to produce structural steel by rolling imported, semi-finished steel products. Later the two plants were referred to as Navard Iran. INSIG also constructed a steelmaking shop (using an electric arc furnace [EAF] and continuous casting [CC] technology) to produce semis by melting steel scrap. Two other bloom plants for processing sponge iron (400,000 tons capacity) were erected in 1972 by the ˆahriya@r Industrial Group; they were nationalized after the Islamic revolution and are now managed by the National Iranian Steel Industries Company (NISCO). The Ahva@z complex supplies these two plants. Also built were the Ahva@z Rolling and Pipe Mills Company to produce 140,000 tons of skelp (steel shaped for pipe-making) per year and the ˆahriya@r Pipe Manufacturing Company to produce 80,000 tons per year of seamless and galvanized pipes (0.5-5 inches diameter), both in 1973.

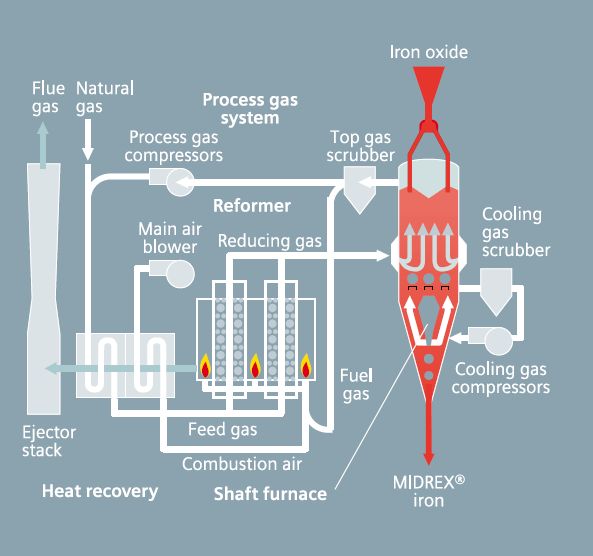

The problems encountered at the Isfahan steel plant and the private sector furnaces (shortage of scrap and quality coking coal) constrained the government’s policy to expand the country’s iron and steel industry to respond to growing domestic demand. The development of new methods of direct reduction processing technology provided a viable alternative for the government, given the fact that Iran had rich resources of natural gas and various required raw materials, in particular, iron ore. The resulted in the establishment of another state-owned company under the name of NISCO in the mid-1970s to produce iron and steel products by utilizing the direct reduction process, as well as to mobilize the relevant iron ore mines. To accomplish this, two contracts were signed between NISCO and a European-American consortium to construct two integrated steel mills in Bandar-e ¿Abba@s (q.v.) and Ahva@z and a heavy rolling mill in Ahva@z.

After the Islamic Revolution in 1979, fundamental changes took place in the Iranian Steel Industry Organization. The two state-owned companies were merged, and NISCO was affiliated to the former Ministry of Mines and Metals, and the Ministry of Industries and Mines was established. NISCO now directs and supervises the Iranian steel industry from the exploration stage of its relevant raw materials up to the marketing of its products in domestic and international markets. As the largest state-owned steel company in the Middle East, NISCO ranked 26 in the table of the world’s major steel producing companies in 1999 and 2000. NISCO is also a regular member of the International Iron & Steel Institute.

During the Iran-Iraq war (1980-88) the steel industry development lost its impetus to some extent. Construction of the Ahva@z Steel Complex (Mojtame¿-e Fula@d-e Ahva@z) had been started in 1974 with a planned capacity of 2.35 million tons per year. Completion was scheduled for 1983, but was delayed by damage due to Iraqi air raids, and the plant cost 40 percent more than originally estimated. However, immediately after the cease-fire and implementation of the First and Second Five-Year Development Plans of the country, the steel industry achieved a considerable growth. In 1988, the volume of steel production did not exceed an annual one million tons. However, it reached 6.3 million tons in 1999 and 6.6 million tons in 2000. This was due to the completion of old projects and the implementation of new ones. Of the old projects the most notable was the Ahva@z Steel Complex, which is built 12 km from Ahva@z on a terrain of 300 ha. The first of the plants was ready for operation in 1989 with a capacity of 550,00 tons per year. Its 150 x 150 mm steel ingots are supplied to NISC, which transforms them into beams and round bars.

The second and third phases (two furnaces and a casting unit) of the Ahva@z Steel Complex were completed by 1989 and 1990, respectively, with a production capacity of 1.6 million tons per year; this output is converted into sheets by the Ka@via@n heavy rolling project (Na@vard-e Sangin-e Ka@viya@n), which is part of the Ahva@z steel complex. Work had started on the Ka@via@n plant in 1976, and it was completed (with delays) in 1989. Its output consists of 400,000 8-40 mm sheets and 300,000 tons of slabs, while it also converts slabs into billets and blooms using the hot rolling method. At Ahva@z there is also the Nasr Steel Mill (Fula@d-e Nasár), which produced 125,000 tons of steel billets in 1988. Its design capacity is 360,000 tons. The Khuzestan Steel Production Complex produced 1,698,000 tons of steel in 2002-03, hitting a record in its annual production. The complex was to produce almost two million tons of steel in 2003-04. Khuzestan Steel Co. (KSC) actually consists of three companies (Ahva@z Steel Complex, INSIG, and Ka@via@n), but in early 1994 NISCO, the mother company, decided to integrate them into one company to better compete in the world market. Further upgrades and expansion also took place at the Isfahan Steel Mill in 1989 when the Italians completed two continuous casting units.

One of the first new projects was the construction of the Iran Alloy Steel Plant (Fula@dha@-ye Alya@ji-ye Ira@n) at Yazd, which started in 1988 and became operational in 1998. It has a production capacity of 120,000 tons of alloy steel sections and 20,000 tons of alloy steel ingots. The capacity may be raised to 200,000 tons later.

Another new project was the Mobarakeh Steel Complex (Mojtame¿-e Fula@d-e Moba@raka), which is the biggest industrial project in Iran. It has been built by an Italian consortium and is located on 35 sq. km of land and has 28 associated plants as well as a number of non-associated ones. Originally it was planned to be built at Bandar-e ¿Abba@s, but it was decided to build 75 km to the southwest of Isfahan to be closer to the Ùa@dormalu coal mines, which added much to the cost of its final products. The Mobarakeh Steel Company is affiliated to NISCO and is also the first integrated flat steel production plant in the Islamic Republic of Iran based on DRI [“direct reduced iron” oxidation]-EAF-CC technology. The plant became operational in late 1992 with a projected production capacity of 2,935 million tons of liquid steel per year. The current capacity is estimated at 2.8 million tons per year. Expansion of the plant to an annual capacity of 4.1 million tons is under way. The expansion contract was signed between Iran and three Italian companies on a buy-back basis.

INSIG (as noted above, part of KSC) also initiated the construction of new capacity such as a bar rolling mill financed by the Italian steel corporation Danieli with a capacity of 550,000 tons of bars on a yearly basis. It also intends to reconstruct its casting and melting shops to increase production to 470,000 tons of crude steel when financing has been secured. INSIG is situated on the Ahva@z-Kòorramæahr road and was nationalized after the revolution. It has seven plants in five sections, including three rolling mills, the first of which started operating in 1967. The INSIG group produces knurled and plain bars, drawn wires, iron beams, angle irons and belt in section 2. Steel and steel girders are made in section 3, while section 4 has two galvanized and non-galvanized pipe-making units (70,000 and 120,000 tons capacity, respectively). The necessary machines are assembled in section 5.

The Isfahan Steel plant will add new capacity to produce some 3.6 million tons of crude steel. The Saba Steel Complex, near Isfahan, which has been designed and constructed by Isfahan Steel Mill, adds a total of 700,000 tons of steel sheets to the country’s annual production. The Khorasan Steel Complex in Nishapur (51 percent privately owned, 49 percent Isfahan Steel) with an annual capacity is 550,000 tons became operational in 2002. Its capacity will be increased with a sponge iron plant and capacity will be increased to 1.3 million tons. The Meybod Steel Project has a capacity of 300,000 of cast iron per year. The Zagros Steel Project in Kurdistan province has a capacity of 70,000 tons of cast iron per year. It is planned to add an agglomeration plant later. The Hormozegan Steel Project has a planned capacity of 1.5 million tons of crude steel. Hormozgan Steel Complex signed two contracts in January 2003. A contract worth USD 300-400 million, for the construction of a 1.5 million-tons-per-year slab and lime calcining plant, was signed with a consortium of Germany’s SMS Demag AG, Iran International Engineering Company (IRITEC) and its subsidiary registered in Italy, Irasco. The estimated USD 140 million contract for the setting up of a 1.65-million-tons-per-year direct reduction iron facility was signed by Germany-registered Mines & Metals Engineering GmbH (MME). NISCO will be the operator of the plant. Financing will be arranged on a buy-back basis, with a structure similar to the one used for the expansion of the Mobarakeh Steel Complex. The buy-back agreement will cover both the project’s international and local content.

To sustain the expansion plans of the steel industry (in particular at Isfahan Steel and Mobarakeh Steel), the ongoing Bandar-e Abba@s Jetty project will enable the handling of 5 million tons per year of minerals at the port, allowing the docking of ships with a capacity up to 150,000 tons. Likewise the Bandar Imam Jetty project enables the handling of 5 million tons per year of iron ore at the Khuzestan Steel Complex. Ships with a capacity of 60,000 tons can dock of the jetty, while further dredging will allow docking of ships of 100,000 tons. Not only port access and capacity are important for Iran’s steel industry, but also the railway system. According to the Ministry of Industries and Mines, 50 per cent of total railway capacity was allocated to transporting the output of the National Steel Company in 2000, and with planned increase of steel production capacity more demand will be made on rail capacity.

World steel production in 2000 reached 850 million tons, of which Iran’s share was 6.7 million tons; Iran then ranked twenty-third among steel-producing countries, and twenty-first in 2004. NISCO reported that the annual production of steel in Iran for 1382 (2003/04) was estimated at 8.13 million tons—the first time that Iran’s steel production would surpass eight million tons. This meant that Iran was able to satisfy 70 percent of domestic demand, while at the same time exporting some 1.5 million tons of steel. Exports constitute a small part of the output of the steel and other metal industries. Only ingots and some aluminum was exported and amounted to less than 1 percent of total exports in 1999. As to imports, except for universals, plates, and sheets (UN International Trade Centre, no. 674), tubes, pipes and fittings (678), and bars, rods, shapes, sections (673) all imports were less than 1 percent of total imports. The location of the Mobarakeh plant at Isfahan rather than near Bandar-e ¿Abba@s constrains its export capacity due to high transportation cost. Investments are ongoing to expand the capacity up to 14.7 and later to 18.4 million tons per year. NISCO has also taken steps toward upgrading the quality of its products and improving the management system with due consideration to environmental protection and better working conditions.

Iran was scheduled to produce some 8.1 million tons of steel and 7.6 million tons of steel slabs in 2003. In 2002, about 7.5 million tons of steel, as well as 7.5 tons of steel slabs were produced in the country, so the country is capable of producing steel and steel slabs in equal amounts. However, the domestic consumption of steel was as high as 11 million tons in 2002, which meant that more than 3.5 million tons of steel were imported. The domestic consumption of steel for 2003 was predicted to be some 12 million tons, which is likely to increase with a boom in the construction sector. This is because, unlike many countries in the world which use concrete and bars, Iran uses iron slates in construction, which also adds to the instability of its buildings. Despite all, Iran managed to export 1.5 million tons of steel products in 2002. Iran’s steel is capable of competing with European products due to its quality and price. The only issue obstructing its path to more exports is domestic demand that outweighs production.

The prospects of Iran’s steel industry seem favorable due to its large and rich raw material resource base, its rich and cheap energy resources, human capital and technical know-how. Iran not only added new capacity during the last 20 years that significantly reduced the country’s import bill and even made export of steel products possible, but it also developed its own technological capacity. Iran, for example, developed its own direct reactivation method of producing iron with 96 percent “metallization,” which works more effectively than the three other conventional methods. The method has been patented and licensed to an Italian company. The Isfahan Steel complex also has been developing innovative techniques of producing spongy iron, manufacturing macro-weighty crafts, etc. Takado Company was established as an investment company and was an affiliate of Isfahan Steel. It started operating with personnel from Isfahan Steel, and after a decade it became one of the largest investment companies in the steel industry. It consists now of 13 companies and has 25 affiliated companies, and it is involved in most aspect of the steel industry.